FUNDS CALCULATOR

Check our Asset Allocation Calculators, Home Loan EMI Calculators, Goal Setting Calculators, Networth Calculators and Spending Less Calculators.

TOP PERFORMING FUNDS

Mutual Fund Trailing Returns, Performance Comparison, Quartile Ranking, Top Fund Performers, SIP Calculators, Rolling Return vs Category and More.

WE ARE

FOSBURY WEALTH takes pride in having been successful in delivering the need-based and realistic investment choice for non-resident and resident investors with excellent client services. As an AMFI registered Mutual Fund distributor, our focus is to deliver sustainable and organic growth to our investors’ drive for wealth creation and goal achievements. Having presence in the Middle East and India, we are well-founded to serve Islamic Sharia investments, Foreign domiciled US dollar funds, and Indian Mutual Funds of all major AMCs to our clients.

Grow Your

INVESTMENT

With Right Partner

CA JOJO JAMES

Jojo James is the founder and CEO of Fosbury Wealth and Fosbury Consulting. He has 15 years of post qualified experience in international banking, corporate finance, taxation, and audit with a successful track record in establishing a lasting relationship with his clients. With expertise in wealth management solutions, he supports the clients to select the right funds matching investors’ goals and risk appetite.

Jojo James is a qualified Chartered Accountant (ICAI) and Cost Accountant (ICWA).

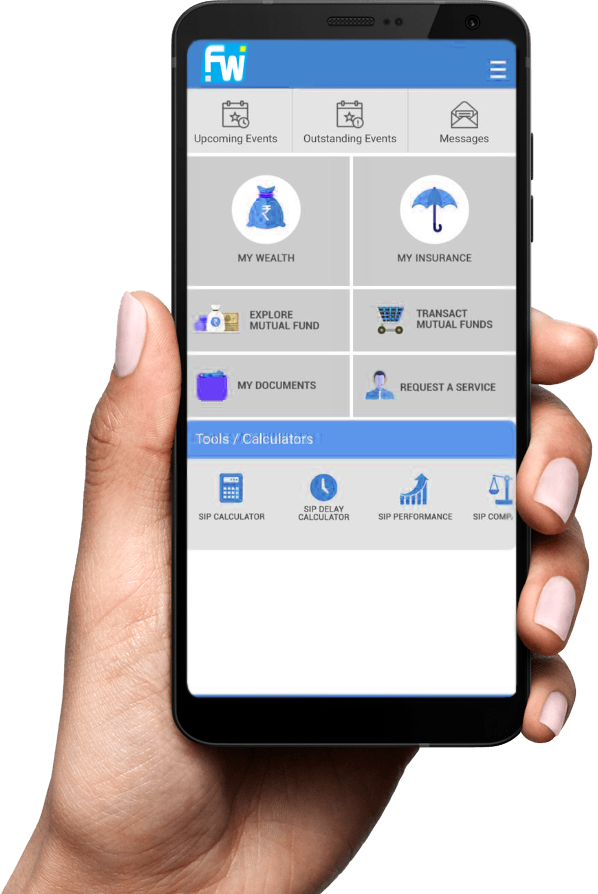

Transact and track your investment in your fingertips anytime, anywhere

Our Web login and Mobile App allows you

- Buy, Redeem, Switch, SIP.

- Explore performing funds.

- Generate Reports of portfolio valuation summary, MF account statement, Capital Gains report, Active SIP report.

SERVICES

Mutual Fund Distribution

Mutual Funds are one of the best avenues for your money to flourish. Mutual Fund is the most viable investment option for a common man as it offers an opportunity to invest in a diversified, professionally managed basket of securities at a relatively low cost.

Systematic Investment Plan (SIP)

Systematic Investment Plan, commonly referred to as an SIP, allows you to invest a small sum regularly in your preferred mutual fund scheme. By activating an SIP, a fixed amount is deducted from your bank account every month, which gets invested in the mutual fund of your choice.

Shariah Compliant Mutual Funds

If you are following the Islamic/Shariah ideologies for investments, we shall provide you the funds which never invest in companies engaged in the business of alcohol, tobacco, pork, weapons, gambling, and financing companies. Also if you are rational to accept the fact that the companies which follow environmental, social and governance standards for sustainable growth, we have ESG funds for your choice.

Insurance

If you have a family that is financially dependent on you, then you need Life Insurance. We provide all kind of insurance advises and products including life insurance, health insurance, auto insurance, accident insurance etc.

UAE

INDIA

UAE

INDIA

ADDRESS

**Disclaimer: Mutual Fund investments are subject to Market Risk. Read all the related documents carefully before investing.